The venue's Invoicing section is where you set up VAT rates, configure financial records, activate gratuity workflows, and more. All of these configurations play an important role in getting your venue configured for success with Sonas. Read on to learn more about each section of Venue Invoicing.

If you cannot see this section or get permission denied messages with any of the actions, please contact your Company Admin in order to get the required permissions.

Video

Where is the Invoicing Section

Navigate to your Venue's submenu and select Invoicing. Venue > Invoicing

What is the Invoicing Section

The invoicing section contains your invoicing settings, which are crucial configurations to ensure that the correct tax rates are applied to your charges, that your financial records follow the appropriate numbering system, and to enable the optional activation and setup of gratuities, as well as the optional conversion of unpaid charges into invoices. These settings are essential to make sure that Sonas meets your accounting requirements. If you are uncertain about how to configure this section, please consult your accountant to confirm the settings in Sonas align with their needs and expectations.

How to set up each part of the Invoicing Section

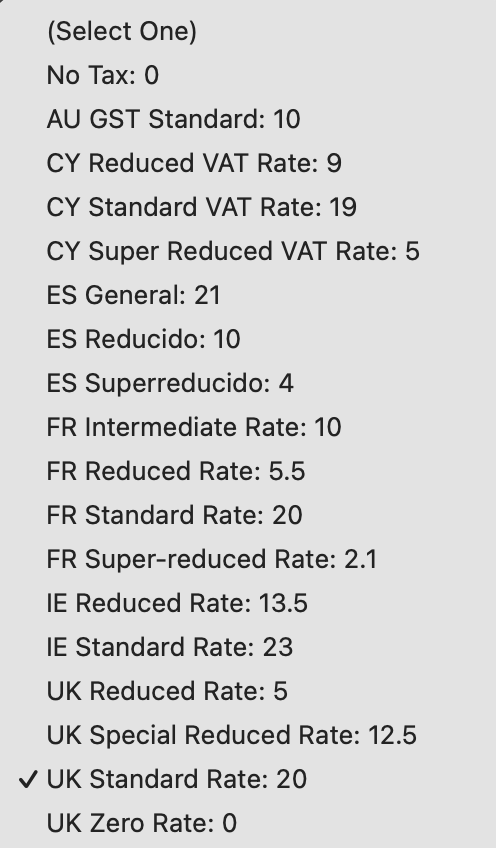

Tax Rates for Transaction Categories

Transaction Categories are used to categorise charges for two purposes:

- Tax Rates- you define the correct tax rate for each category so the base and tax is correctly calculated on your tax inclusive pricing.

- Revenue Reports- you can run reports based on transaction categories, be it looking ahead to forecast all venue hire, or looking back to see revenue generated by food.

Default Transaction Categories:

- Alcoholic Drinks

- Food

- Gratuity

- Soft Drinks

- Tax Exempt

- Venue Hire

- Venue Services

Even if you will not use one or more of the default categories, you still must assign the correct tax rate to it.

You can add additional custom transaction categories, like Accommodation, via Categories. Anytime you add an additional transaction category, return to the venue invoicing section to apply the correct tax rate.

To apply a tax rate, click on the tax rate box and select the correct rate. If what you need is not listed, please reach out to your Company Admin to request that the tax rate be added by the Sonas tech team. Once you have all tax rates selected, click Save.

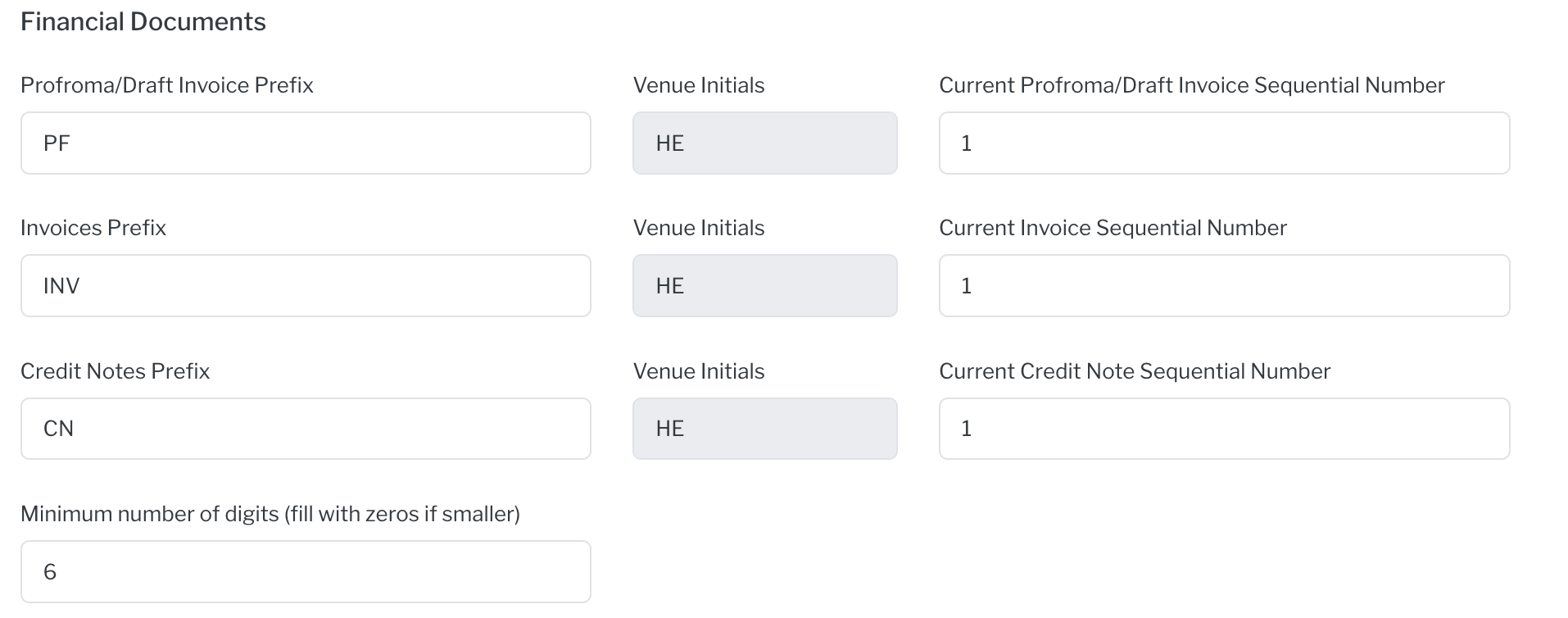

Financial Documents

Sonas generates three financial records- Proformas/Draft Invoices, Invoices, and Credit Notes. In the financial documents section you can change the document prefix if necessary and the starting number for the documents. Lastly, select the minimum number of digits for the documents, this defaults to the system's minimum of 6. The final reference for the financial document is Prefix - Venue Initials - Number, i.e. INV-VI-000006.

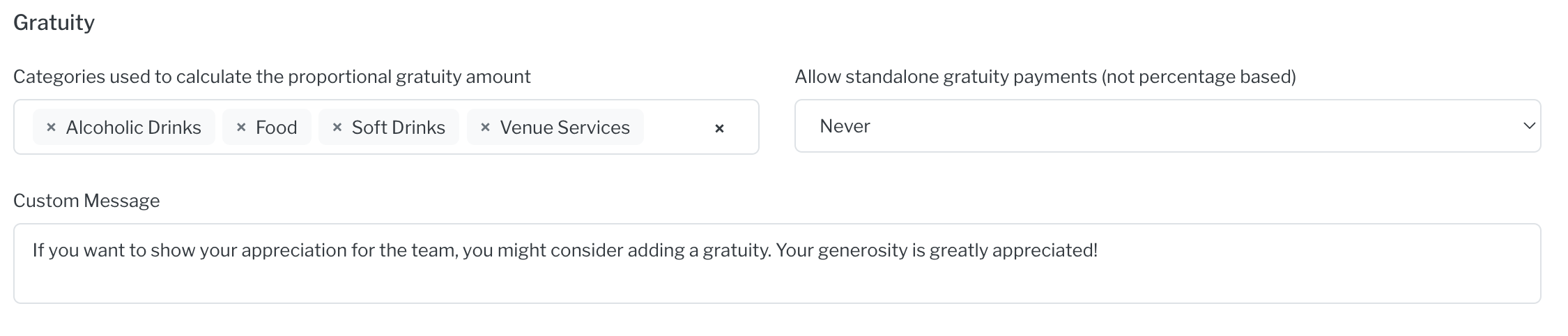

Gratuity

Here is were you select the transaction categories eligible to calculate a % gratuity on, if activated. Plus some additional gratuity configurations. Please see Gratuity for an in-depth guide to gratuity and how to configure it.

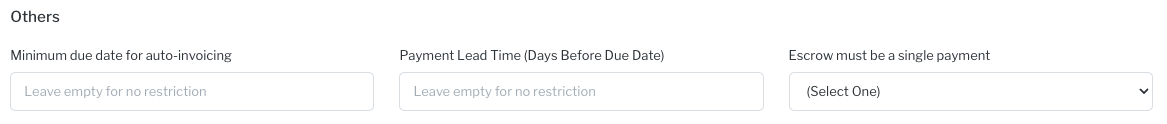

Others

This section covers other financial configurations available for your venue.

Minimum date for auto-invoicing: This setting determines the earliest due date for which a scheduled payment will be automatically converted into an invoice. For instance, if you set this date to 1st October 2025, only payment items due on or after this date will be subject to auto-invoicing. For a complete guide on how this feature works, please see our article on Event Types.

Payment Lead Time: This optional setting creates a payment window, preventing clients from paying an invoice too far in advance of its due date. For example, setting a lead time of 30 days will prevent a payment from being made more than 30 days before it is due.

Escrow must be paid in a single payment: This setting requires you to choose Yes or No. Selecting Yes means that any charge marked as 'Escrow' must be paid in full with a single transaction; partial payments will not be permitted. This ensures the entire escrow amount is on one invoice, which simplifies the refund process as only a single credit note will be required later.

Best Practices for the Invoicing Section

- Be sure to click Save after any changes

- Even if you don't use something, like a transaction category, you still need to put in the correct related information.

- Disable editing this section for users who don't need to edit this for their role.

- Speak to your accounts team to assist you in setting this section up.