Sonas offers a quick and efficient way to export your financial records (Invoices and Credit Notes) in a format compatible with Sage 50. This guide will walk you through how to connect and configure the Sage export feature.

Permission required: If you can't access the Sage integration section or see a "Permission Denied" message, please contact your Company Admin to request the appropriate access.

Video Tutorial

Step 1: Connect the Sage 50 Export

Go to Venue > Integrations in the Sonas dashboard.

Find the Sage tile and click the blue

+(plus) icon.

Step 2: Map Your Sage Settings

Once connected, you’ll need to match Sonas transaction types and tax rates with your Sage configuration:

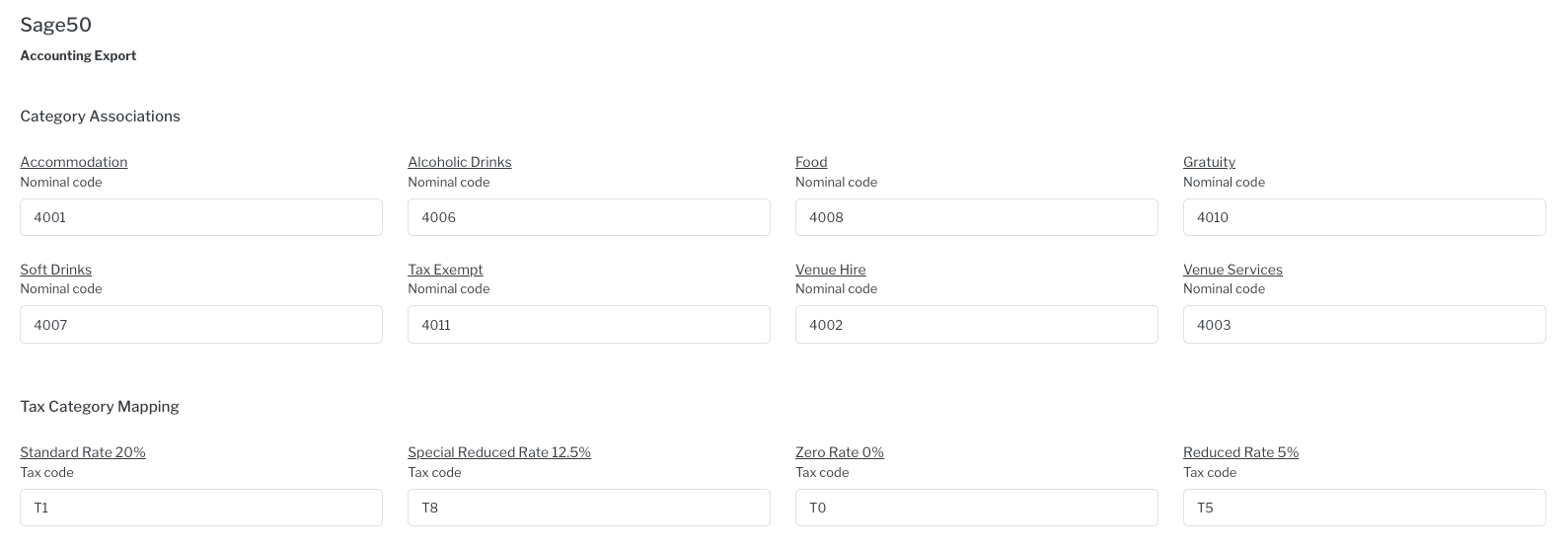

Nominal Codes: Map your Sage nominal codes to the corresponding Sonas transaction categories (e.g., venue hire, food, services).

Tax Codes: Match your Sage tax codes with the VAT/tax rates set in Sonas. This ensures smooth import and accurate reporting.

Step 3: Save and Confirm Connection

After mapping your codes:

Click Save

The integration will now show as Connected

You're now ready to export financial data to Sage in a compatible format from the export section of the platform.

If you need help generating or importing the Sage export file, check out our full guide: Using the Sage Financial Export File